CONSULTANCY AND SERVICES

HOUSEHOLDS

Certificati Bianchi

Tax breaks

for Energy Efficiency interventions

Thermal Account

Energy Certification

Tax breaks

The tax breaks consist of a reduction in IRPEF (personal income tax) or IRES (tax on company earnings) and this reduction is triggered when work is carried out that improves the energy efficiency of existing buildings or restructuring work. The breaks come in equal annual reductions over a ten year period.

Restructuring, substituting out-dated plant, adding the safety of your home in different ways, carrying out anti-seismic, knocking down or moving walls, flat conversions, reducing energy consumption in homes and condominiums: all these operations are eligible for considerable tax reductions under at least one of the incentive schemes introduced by the government in recent years.

At present the tax reductions subdivided between conversions (65% of the cost) and restructuring work (50% of the cost).

The classic building works of extraordinary maintenance or restoration come under the scheme, with a reduction of 50%. The same applies to ordinary maintenance work, provided that it is covers the communal parts of a condominium. This also goes for work such as the demolition of architectonic barriers, cleaning up asbestos, the installation of security devices for the home and for safety measures.

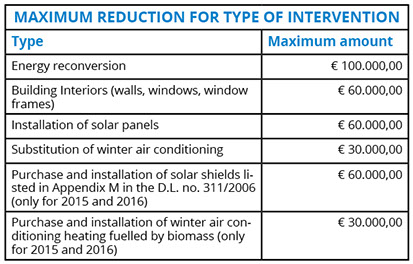

Below, instead, the are the eligible interventions for the energy conversion (65%):

- Reduction of energy consumption for heating

- Improved building insulation (floors, window frames and windows etc.)

- Installation of solar panels

- Substitution of winter air conditioning

Who can apply

All resident and non-resident taxpayers can apply, including owners of businesses in possession

of the building in question. In particular the following are eligible:

- Individuals including artisans and professionals

- Tax payers (individuals, companies etc.)

- Professional associations

- Non-profit public and private organisations

Also family members and partners of the owner or legal tenant of the building in question can apply (even distant relatives provided they cover the cost of carrying out the work).

arkesrl@guidogroup.com PEC: info-arke@legalmail.it

C.F. - P.IVA: 03371190780

webdesign SkillGrafica

Registered office: Via L. Ariosto, 3 - 87100 - COSENZA (Italy) - tel. +39 0984 466654

North Italy operative branch: via Tonale, 9 - 20125 - MILANO - tel. +39 02 39289261

Central Italy operative branch: via Sante Bargellini, 4 - 00157 - ROMA - tel. +39 06 83952370

E.S.Co. Arké S.r.l.

PRIVACY POLICY